Specifications

Material

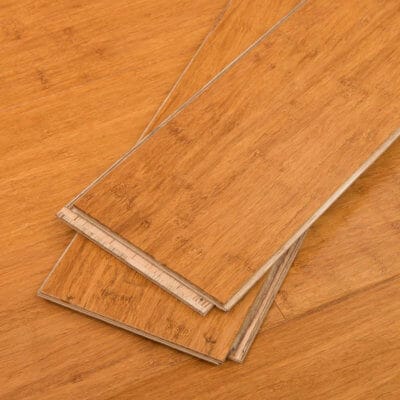

100% bamboo

Sizes

BP-VA153696-ULEF – 1.5″ x 36″ x 96″ (38mm x 914mm x 2440mm)

BP-VA152596-ULEF – 1.5″ x 25″ x 96″ (38mm x 635mm x 2440mm)

BP-VA152572-ULEF – 1.5″ x 25″ x 72″ (38mm x 635mm x 1829mm)

Finish

Unfinished

Fire Rating

Fire resistance classification: Class C

Test surface burning in accordance with ASTM E 84

Weight

BP-VA153696-ULEF -1.5″ x 36″ x 96″ : 130 lbs

BP-VA152596-ULEF -1.5″ x 25″ x 96″ : 90 lbs

BP-VA152572-ULEF -1.5″ x 25″ x 72″ : 68 lbs

Downloads

Download here all the material you will need for your next woodworking project.

Working with BamBüPly™ Bamboo Countertops

Preserve the beauty of your bamboo countertop with our expert installation and maintenance tips, ensuring pristine and stunning surfaces for years to come.

Working with BamBüPly™ Bamboo Plywood

Learn how to work with architectural grade bamboo plywood. Discover the different variations of structure and all there is to know about acclimatization.

LEED® Credits

BAMBOO DESIGN AND LEED® CERTIFICATION

All bamboo plywood products offered by Bamboo Design & Architecture are eligible for LEED® certification.

LEED® credits possible:

IEQc4.4: Low-Emitting Materials – ULEF (Ultra Low Emitting Formaldehyde)

MRc6: Rapidly Renewable Materials

MRc7: Certified Wood

LEED® Canada has changed the way we see our living, working and learning environments. LEED®, which stands for Leadership in Energy and Environmental Design, is a certification program directed by an independent organization. It is also an international benchmark for designing, building and operating environmentally friendly and highly energy-efficient buildings.

Interest in low-environmental-impact residential and commercial buildings continues to grow. American studies are already showing that in certain markets, LEED®-certified houses are selling for 8% higher and don’t stay on the market as long as similar uncertified homes.

Visit the Canada Green Building Council’s website to learn more.