Les Plus Durs au Monde

Les Planchers Fossilisés®, tout simplement les planchers les plus durs au Monde !

Cali Bamboo fabrique des planchers qui ne s’embosseront pas, ne s’égratigneront pas ou ne s’useront pas par l’usage quotidien.

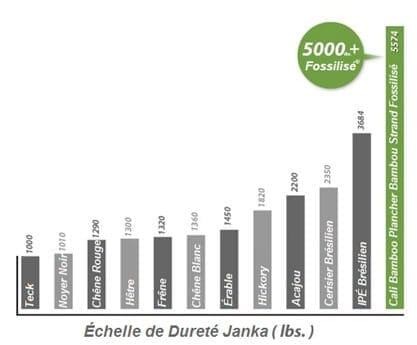

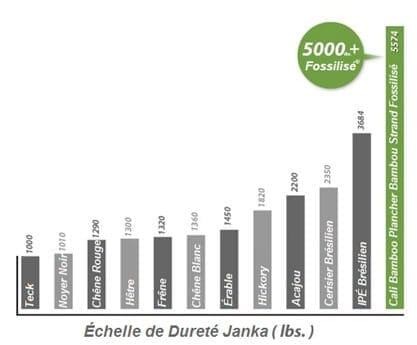

Chacun des planchers offerts par Cali Bamboo est testé selon la bille Janka pour non seulement s’assurer qu’il répondra à la dureté recherchée mais également qu’il continuera d’avoir l’apparence d’un plancher nouvellement installé pour des années à venir. Les planchers d’Eucalyptus Fossilisés® Cali Bamboo sont les planchers les plus Durs au monde, un classement sans précédent allant jusqu’à 5,547 livres force sur le test Janka!

L’Échelle de Dureté Janka

L’Échelle de Dureté Janka, utilisée pour déterminer si une espèce de bois est appropriée pour être utilisé comme plancher, représente le test principal pour mesurer la résistance du bois à l’usure et aux égratignures. Comment le test fonctionne? Le test Janka mesure la force requise pour enfoncer la moitié d’une bille d’acier de 11.28mm dans une pièce de bois. Plus la force requise est élevée, plus haut sera le classement Janka et plus dur sera le bois.

Cali Bamboo utilise 30% plus d’Eucalyptus dans son processus de fabrication Fossilisé®

Obtenez un échantillon et Découvrez la différence Cali Bamboo!

Qu’est-ce que cela signifie pour vous

La combinaison unique d’Eucalyptus Fossilisé®, jumelée d’une protection additionnelle de 10 couches ultra résistantes, crée un plancher qui saura résister à l’épreuve du temps… ainsi qu’à la vie quotidienne. Les planchers d’Eucalyptus Fossilisés® de Cali Bamboo sont tout à fait désignés pour tout type de chiens, sont à l’épreuve des talons hauts et en comparaison de plusieurs autres types de planchers, sont sans émissions toxiques ou ajout d’urée de formaldéhyde. Les planchers de Cali Bamboo® représentent non seulement les planchers les plus durs mais également les planchers les plus sécuritaires pour la qualité de l’air de votre résidence ainsi que la santé de votre famille.

Accessoires

Accessoires de planchers

La qualité réside dans les détails. Les accessoires des planchers Cali Bamboo sont fabriqués à partir des mêmes matériaux de haute qualité et sont soumis au même processus breveté de fabrication. Ils donnent à l’ensemble de votre projet de plancher un aspect élégant et professionnel.

Tous les accessoires sont disponibles sur demande et sont assortis au fini et couleurs de votre plancher.

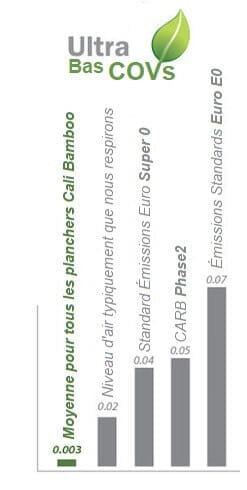

Respirez Librement

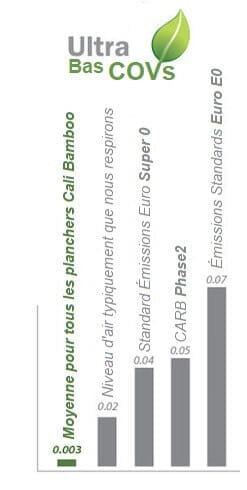

Les résultats des tests de laboratoires ASTM démontrent que les planchers de Cali Bamboo sont 100%  Ultra-bas en COV

Ultra-bas en COV

Lorsqu’il s’agit de qualité d’air intérieur, notre préoccupation première demeure le niveau d’émissions des composés organiques volatiles (COV) spécifiques tel le formaldéhyde. Bamboo Design a été le premier à vous offrir des planchers de bambou sans émanations de formaldéhyde dans son processus d’assemblage et nous sommes l’un des rares qui maintiennent un niveau de transparence en affichant le résultat de ses tests en ligne, accessible à sa clientèle.

- Plusieurs de nos planchers enregistrent un niveau de concentration « Not Detectable » de moins de 0.000 parties par millions (PPM) — cela signifie que ces planchers sont Ultra-Bas en COV.

- Ceux affichant un niveau de concentration détectable sont tout de même 50 fois plus bas que les émissions standards les plus rigoureuses CARB (California Air Resources Board) Phase2 (0.05 PPM).

- En fait, les résultats ont même démontré que tous les niveaux de concentration de formaldéhyde de nos planchers rencontraient au minimum la moitié de la concentration rencontrée dans l’air typiquement que nous respirons. (0.02PPM)

Au contraire de certaines compagnies qui coupent les prix par l’utilisation de matériaux de moindre qualité, Bamboo Design choisi de travailler avec les meilleurs fabricants au monde qui ont le souci de s’approvisionner de sources forestières durables de qualité supérieure et qui maintiennent un processus de fabrication irréprochable.

Respirez librement avec Cali Bamboo

Qu’est-ce que le formaldéhyde?

Cancérigène, le formaldéhyde est l’un des polluants les plus sérieux de nos intérieurs. Le formaldéhyde est un gaz incolore, très volatile qui est émis principalement par les produits ménagers, panneaux de bois et revêtements de plancher. L’odeur piquante, détectable à très faible concentration (à partir de 0,6 mg par mètre cube d’air) provoque des irritations et des inflammations des yeux, du nez et de la gorge et peuvent aggraver les symptômes de l’asthme chez les enfants et les nourrissons.

Gardez votre famille en sécurité et en santé en choisissant des planchers sans produits chimiques douteux. Cali Bamboo ne coupe jamais les coins ronds en ce qui a trait à la qualité des matériaux, adhésifs et techniques manufacturières et nous avons le résultat des tests pour le prouver!

Tous nos planchers sont Ultra Bas en COV, certifiés FloorScore® , la plus haute reconnaissance en qualité de l’air de l’industrie.

Installation et maintenance

Effectuez l’installation et la maintenance de votre plancher comme un PRO!

Nous avons rassemblé dans ces documents toute l’information nécessaire à la bonne conduite de votre projet pour assurer une installation tout à fait impeccable.

Vous avez des questions additionnelles? Faites-nous signe !

Guide Pré-Installation

Évitez le dérapage en suivant ces deux étapes les plus importantes, l’acclimatation et les joints d’expansion.

Guides d’Installation

Simples à suivre voici les instructions officielles d’installation des planchers Cali Bamboo pour installer en toute confiance et assurer la réussite de votre projet.

Entretien & Maintenance

Apprenez à maintenir votre plancher en parfaite condition pour des années à venir en suivant ces étapes simples et efficaces pour l’entretien de votre nouveau plancher.

Crédits Leed®

Les Points LEED®

Tous les planchers de Bamboo Design & Architecture sont éligibles à l’obtention de crédits dans le cadre d’un projet LEED®.

Voici les crédits qu’il est possible d’obtenir :

IEQc4.4: Matériaux à faibles émissions (Sans urée formaldéhyde ajoutée)

MRc6: Matériaux rapidement renouvelables

MRc7: Bois si certifié FSC

Crédit pour certification FSC sur produit spécifié seulement :

MRc7: Bois certifié

LEED® qui signifie Leadership in Energy and Environmental Design, est un programme de certification orchestré par un organisme indépendant ainsi qu’une norme de comparaison reconnue dans plus de 132 pays comme la marque internationale d’excellence pour les bâtiments durables.

Consultez le site du Conseil du Bâtiment Durable du Canada pour plus d’information

FAQ

Q. Pourquoi je devrais choisir les planchers Cali Bamboo® pour mon projet?

R. Il y a plusieurs avantages à utiliser les plancher Cali Bamboo® en comparaison des plancher de bois franc traditionnels.

Avantages Environnementaux

L’Eucalyptus représente le matériau de bois le plus respectueux de l’environnement sur la planète puisqu’il est officiellement

la plante à la croissance la plus rapide. Un arbre tel que le chêne prendra entre 30 à 50 années à atteindre sa maturité alors que

l’Eucalyptus pourra être récolté de façon durable pour des planchers tous les 5 à 7 années.

Avantage Structurel

Les planchers d’Eucalyptus peuvent être deux fois plus durs que les planchers de chêne et prendront deux fois moins d’expansion que la plupart des bois francs ce qui contribue à rendre les fibres d’Eucalyptus beaucoup plus intéressantes pour la fabrication de planchers. Ses caractéristiques physiques uniques le rendent plus approprié dans une variété d’applications et de type d’installation.

Avantage Logistique

Au contraire des autres compagnies qui vendent l’Eucalyptus, Cali Bamboo® produit ses propres planchers et livre directement de ses centres de distribution contribuant à un accès plus rapide et efficace.

Q. Comment effectuer l’entretien de mon plancher d’Eucalyptus?

R. Voici quelques pratiques de base qui vous aideront à maintenir votre plancher en bonne condition pour des décennies à venir:

Maintenance

Nous recommandons de passer l’aspirateur ou le balai sur une base régulière pour retirer la saleté, le sable ou le gravier. Épongez l’eau renversée immédiatement avec une vadrouille sèche. Ne jamais passer une vadrouille détrempée sur votre plancher. Protégez votre plancher du déplacement des meubles en vous assurant de mettre des feutres aux pattes de chaises ou meubles. Soulevez les meubles plus lourds, ne pas glisser les pièces lourdes ou électroménages sur le plancher. Faites couper régulièrement les ongles de vos animaux de compagnie pour éviter qu’ils n’égratignent le plancher. Évitez les tapis à revers de caoutchouc, de vinyle ou les tapis qui ne respirent pas. Limitez les rayons de soleil sur votre plancher par l’utilisation de rideaux ou stores/volets roulants aux endroits exposés à des rayons UV élevés. Maintenez une humidité relative entre 40% à 60%. La cire et l’huile à plancher ne doivent pas être utilisés.

Q. Quelles sont les différences entre les espèces variées d’Eucalyptus et laquelle correspondra à mes besoins?

R. Il existe plusieurs procédés manufacturiers différents dans le monde des planchers d’Eucalyptus et également plusieurs couleurs et dimensions variées vous offrant ainsi une multitude de planchers aux styles différents parmi lesquels faire votre sélection. Au moment d’effectuer votre choix, prendre en considération ces deux caractéristiques:

- La technique manufacturière du plancher Solide d’Eucalyptus. Cette technique est le moment ou l’Eucalyptus est coupé en lanières rectangulaires qui seront laminées ensemble. Si les lanières sont laminées côte-à-côte laissant la face visible, cette méthode s’appellera Horizontal. Si ces mêmes lanières sont plutôt laminées face contre face laissant le côté étroit seulement visible, ce grain s’appellera Vertical.

Sans égard à la couleur ou dimensions variées faisant référence aux différences visuelles, le choix initial du matériau brut ainsi que la méthode par laquelle les lanières seront laminées feront une différence très importante et catégoriseront l’Eucalyptus en différentes qualité. Le processus de finition, lequel protège le plancher de l’usure normale quotidienne, représente également un autre point majeur déterminant dans la qualité général d’un plancher. Une finition de haute qualité est une étape cruciale

mais peut malheureusement passer totalement inaperçue par l’acheteur. Un plancher à petit prix pourrait donc s’égratigner à partir d’un simple coup d’ongle alors qu’une finition de qualité pourra soutenir la chute d’objets lourds sans aucun dommage.

- Les fibres compressées (collection Fossilisées de Cali Bamboo®) – Dans cette méthode de fabrication, l’Eucalyptus sera composé de lanières de dimensions variées puis compressées sous une pression extrême le tout combiné à un adhésif spécifique sans COV. Ce processus de fabrication produit un plancher qui sera beaucoup plus dur et plus dense que les planchers d’Eucalyptus traditionnels ainsi que la plupart des planchers de bois francs. Ce processus de fibres compressées — ou fossilisées — crée un grain au visuel plus naturel et non linéaire, similaire aux planchers traditionnels de bois francs mais avec une solidité et une durabilité significativement supérieure.

Q. Comment dois-je installer mon plancher d’Eucalyptus?

R. Cela dépendra du type de sous-plancher, du plancher existant ainsi que de son application mais il existe deux façons de base d’installer le plancher d’Eucalyptus:

- La méthode Collée

- La méthode Clouée

Consultez notre équipe d’experts pour déterminer la meilleure technique d’installation appropriée à votre projet 1-844-293-6060.

Q. Vendez-vous les accessoires de plancher tels que les pièces pour les escaliers ou les moulures de transition?

R. Oui, nous vendons tous les types d’accessoires de plancher en Eucalyptus ainsi que les pièces pour les escaliers incluant les marches d’escalier, les contremarches, les nez-de-palier, les réducteurs, les transitions, les quarts-de-rond, les seuils et les plinthes pour compléter votre projet de façon professionnelle.

Ultra-bas en COV

Ultra-bas en COV