CHINA BULLETIN: Bring on the Equipment Upgrades, Says Beijing

In this week’s issue spying cranes, a TikTok sale and a meaty IPO. On a scale of 1 to 100, we give the week a 60 for offshore-listed China stocks.

Doug Young, Editor in Chief

You can sign up to get China Bulletin weekly in your inbox.

MACRO

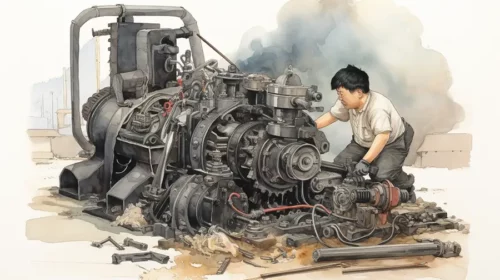

Bring on the Equipment Upgrades, Says Beijing

If infrastructure is nearest and dearest to Beijing’s heart, then manufacturing and industrial equipment are probably a close second. So it should come as little surprise that Beijing has called on businesses and consumers to upgrade their equipment, with the government’s newest stimulus directive going out to sectors including agriculture, transport, education and healthcare.

The State Council, which issued the call, wants those sectors to increase their equipment spending at least 25% by 2027, saying such efforts would get unspecified government support. This kind of spending is what Beijing loves best, as it involves huge amounts of money that ultimately go to the real economy and generally support the nation’s manufacturing sector.

U.S. Investigates Chinese Cranes

First it was Chinese telecoms equipment, then it was TikTok. Now the latest boogeyman threatening U.S. national security is Chinese-made cranes. At least that’s the suspicion of some U.S. House members, who are trying to determine the purpose of telecommunications equipment with no apparent purpose built into Chinese-made cranes at U.S. ports.

The cranes come from a company called ZPMC, which issued a vanilla statement saying it always complies with laws of countries where it operates. We’ll need to wait for any findings before passing judgment in this matter. But that said, any signs that the cranes are sending information back to China certainly won’t look good.

China Stocks Poised for Comeback?

After taking a breather two weeks ago, offshore-listed China stocks returned to their recent winning ways with more modest gains last week. The Hang Seng China Enterprises Index gained 2.9% for the week, while the iShares MSCI China ETF was up 2.8%. The broader Hang Seng Index rose 2.3%, and is now up about 9% from a recent low in mid-January.

More noteworthy, the Hang Seng Tech Index and the Mainland-based ChiNext both officially entered bull market territory last week, meaning they were trading 20% higher from their January lows. Tech stocks have taken some of the biggest beatings over the last two years, so it’s not surprising to see them bouncing back. Whether they can sustain the gains remains to be seen.

Industry

We previously wrote that some recent negative publicity around new energy vehicles could have a negative effect on consumer sentiment, and that already appears to be happening. A new survey by McKinsey on how car owners feel about their NEVs found that 22% wouldn’t buy an NEV again due to charging issues, up sharply from the 3% that answered that way in 2022.

The results reveal a large divide between NEV owners in smaller cities, 54% of whom said they wouldn’t consider an NEV again, versus just 10% who felt that way in larger cities. Infrastructure issues aside, the past winter has also been hard on NEVs after owners in some northern cities discovered their cars don’t work so well in very cold temperatures.

Nissan, Honda Cut Car Production

While NEVs are facing some challenges, they still command a huge part of China’s new car sales these days, as much as a third. That’s problematic for makers of traditional gas-powered cars, whose manufacturers are suddenly finding themselves with lots of idle capacity as their share of the overall Chinese car market rapidly shrivels.

In response to that, Japan’s Nissan is reportedly getting ready to reduce car production at its Chinese joint venture by up to 30%, while Honda is planning cuts of up to 20%. This report focuses on the Japanese automakers because it comes from Japan’s Nikkei Asia. But other auto majors like GM, Volkswagen and China’s own Geely are almost certainly weighing similar cuts.

No Joy for New Home Prices in February

February may have been a month of celebrations for Chinese families during the Lunar New Year, but there was no joy for the struggling property sector. New home prices continued their losing ways in the month by falling 0.3% from January levels, marking an eighth consecutive month of declines, according to data from the National Statistics Bureau.

China has begun taking a targeted approach to shoring up the property market by specifying who should receive priority funding, after numerous more general approaches failed to have much effect. Credit woes aside, consumer confidence is one of the biggest obstacles to a recovery right now, and that looks unlikely to change as long as prices keep falling.

Company

U.S. Passes Bill Forcing TikTok Sale

The vultures continued circling the popular but also increasingly endangered TikTok last week, as the U.S. House of Representatives voted to ban the short video sensation unless its Chinese parent, ByteDance, sells the app’s U.S. operation. The action was surprisingly swift and bipartisan, with both Republicans and Democrats supporting it over national security concerns.

From the House, the bill would still need to be passed in the U.S. Senate, which hasn’t indicated how it might act. President Biden has said he would sign it. Former President Trump tried to launch a similar effort during his time in the White House, though no one took it too seriously. But much has changed since then, and the rapid movement this time is also tied to election-year politics.

Bottled Water King Comes Under Fire

In a story that could only happen in China, the country’s leading bottled water maker has come under fire for something as simple as the color of its trademark red-and-green bottles. In this case, it’s the red color of the bottle caps that put Nongfu Spring in the spotlight, with nationalists saying the caps bear an uncanny resemblance to the Japanese flag’s Rising Sun.

We don’t usually comment too directly on this kind of thing, but here we have to say: Give me a break. Red is quite a common color on Chinese food packaging, and a trip to the supermarket would uncover many more Japanese sympathizers, based on that criteria. On a more serious note, this case seems to point to a recent uptick in such activity by online nationalists.

We previously noted that Beijing is taking a more targeted approach to propping up the country’s ailing real estate sector. That tack is showing up in a new report saying the state-owned sector is being asked to support embattled developer Vanke. For one, the government is asking creditors to consider letting Vanke extend payments on its maturing debt.

This isn’t the first time Vanke has gotten into trouble, and previously its hometown Shenzhen government and the local subway authority came to the company’s aid. Beijing’s involvement seems to indicate two things: One, that the central government finally realizes a true crisis is happening, and; Two, that it is creating a “white list” of companies it feels are “too big to fail.”

AND FROM THE PAGES OF BAMBOO WORKS

| CStone Dives After Hang Seng Ejection Last week we bought you the story of what could well be the canary in the coal mine for China’s dozens of money-losing drug companies that have listed in the U.S. and Hong Kong over the last five years. The tale involved CStone, a drug maker that got booted from the Hang Seng Index, and subsequently the Hong Kong-China stock connect program, after its value fell too low. Normally this may sound like a technical thing. But in CStone’s case the ejections had very real-world consequences, triggering a nearly 40% plunge in the company’s stock. A number of other drug makers experienced similar fallout with the Hang Seng Index’s latest update, signaling an accelerating fall from favor for this money-losing group. |

| China Loves Cured Meat. But Will Wing Yip’s Satisfy Investor Palates? We also brought you the story of a century-old company called Wing Yip, which is hoping to whet New York investor appetites with the story of its leading position making popular Chinese cured meats. The company has filed to list on the Nasdaq, in a deal that could raise up to $30 million. Perhaps cured meats isn’t the biggest growth industry, and Wing Yip’s IPO prospectus shows the company isn’t growing very quickly these days. But in turbulent times where new economy companies face an uncertain future, this kind of slightly exotic, comfort-food offering could be just what the doctor ordered for investors hungry for some slow but stable growth. |